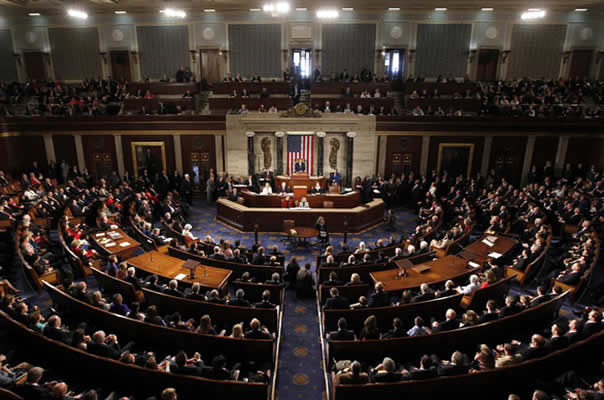

At last, the U.S. Congress has officially passed President Donald Trump’s sweeping legislative package, known colloquially as the “One Big Beautiful Bill”, sending it to his desk just before the July 4 holiday deadline in the U.S.

The House of Representatives approved the bill Thursday in a narrow 218–214 vote. The had previously scaled the U.S Senate’s with a slim margin of 51–50 (Republicans versus Democrats), with Vice President J.D. Vance casting the deciding vote. Two Republicans joined Democrats in opposing the measure in both chambers.

The legislation makes permanent the 2017 Trump-era tax cuts and expands new tax breaks, such as deductions for tips, overtime wages, car loans, and a $6,000 credit for families earning under $75,000. It also raises the cap on state-and-local tax deductions.

On the spending side, approximately $350 billion is allocated toward national defense, border security, and a missile-defense project known as “Golden Dome”.

These gains are offset by cuts to Medicaid and SNAP, including the introduction of work requirements and the rollback of clean-energy tax incentives.

According to the Congressional Budget Office, the measure is expected to add $3.3 trillion to $3.4 trillion to the national debt over the next decade and could leave an additional 11.8 million Americans uninsured by 2034.

Democrats, unified in opposition, criticized the legislation as House Minority Leader Hakeem Jeffries staged a record-breaking 8-hour-44-minute speech, labeling the bill “cruel”.

Even within the GOP, voices of dissent emerged. Moderate Republicans expressed concern over the growing deficit and the impact of social-program cuts.

Speaker Mike Johnson, celebrating the victory, told reporters, “For everyday Americans, this means real, positive change that they can feel.”

With the bill now headed to the White House, a signing ceremony is expected on July 4.

President Trump’s supporters are hailing it as a patriotic achievement fulfilling campaign promises, while opponents fear the long-term strain on the social safety net and federal budget could have grave consequences.